TOKYO–(BUSINESS WIRE)–Uchiyama International Co., Ltd:

Dear Valued Fujitec Shareholders,

As you may be aware, ISS, a proxy advisory firm, has just issued voting recommendations on the upcoming Annual General Meeting of Fujitec Co., Ltd. to be held on 21 June 2023.

In its report, ISS recommends that its clients vote against resolutions 5.1-5.8 (“Election of eight (8) directorsâ€).

In relation to resolutions 5.1-5.8, ISS argues that:

- “Uchiyama International is seeking to take control of the board but has presented no plans to be adopted after taking control of the boardâ€

- ISS are “unaware of incidents casting doubt over Fujitec’s board since it was reconstituted in February 2023.â€

- “Although it is too soon to tell what impact the new board may have on the company’s financial results, the share price has increased 11.9 percent since the new board members were elected to the date of this analysis (June 2) and is trading at levels not seen in more than a decade; suggesting that the market is optimistic about the company’s prospects under the new board and management teamâ€

- “While the dissident candidates include those with diverse business background, profound experience and skill sets, the dissident presents no specific plan to be implemented after taking control of the board. In addition, to bring about a significant change again to the board which was just reconstituted three months ago would not be ideal. Worse, that would cause disruption to the management of the companyâ€

We respectfully disagree with these ISS recommendations and assessments. We feel strongly that the proposed resolutions are in the best interest of all shareholders. Set out below are some key issues we believe you should consider when assessing the proposals:

Alternative business strategy

ISS’s framework for contested elections states that “when the dissidents are seeking board control, ISS looks for a well-reasoned and detailed business plan (including the dissident’s strategic initiatives), a transition plan that describes how the change in control of the company will be effected, and where management continuity may be an issue, the identification of a qualified and credible new management teamâ€.

This policy makes apparent sense in a “normal†activist situation where a long-standing incumbent board is being challenged on failed business strategy, lost opportunities, failed capital management or independence concerns.

This was the case at the recent February EGM, when Oasis was the dissident investor. But now, the situation is fundamentally different. For the 21 June AGM, there is a slate of non-aligned candidates, independent of each other and of their nominating shareholder, collectively putting themselves up as a diverse team against the recently installed incumbents. These incumbent directors received low levels of support from shareholders at the February EGM, do not have a clear mandate, and appear clearly aligned to the voice of a single major shareholder.

We want to respectfully highlight that if our nominees had in fact proffered a detailed alternative business strategy, they would have been accused of being in collusion with each other and with the proposing shareholder and closed-minded to alternative strategic directions that they could work on with company management and their fellow directors, employees, customers, and suppliers to articulate once elected.

As the shareholder nominee candidates are independent of each other as well as of Uchiyama International, this would also have required prior collusion on arranging an alternative strategy before having access to management or establishing a collegiate relationship with their fellow directors, executive and customers.

The communication material that was shared with ISS and major investors did in fact cite several high-level strategic risks and opportunities that the independent candidates are better equipped to address than the incumbent Board. For example, our nominees noted the high degree of exposure that Fujitec has to cyclical changes in the property and construction sector, and the need to remain vigilant to the impacts of a high interest rate and inflation cycle, post-pandemic changes in workforce participation, and sustainability and engineering challenges in the built environment as developers seek to retrofit existing buildings rather than construct new ones. Our proposed candidates bring a wealth of experience and skills in all of these fields – complementing and not simply duplicating the specific domain expertise in elevators that primarily lies in Fujitec’s management team.

We strongly believe that these higher-level attributes are what is needed to navigate the strategic risks and opportunities that face the company today – and which long-term focused investors would expect to see at the governance level of a major listed company.

To call the Uchiyama International perspective an “emotional†response lacking sufficient details or commercial acumen is disappointing. On the contrary, it is an appropriate governance-led approach founded on the principle of boards being accountable for oversight of strategy and risk as well as the preservation of shareholders’ interests, not micro-level implementation of a pre-conceived strategy. The right outcome here is for directors to be elected with a genuine open mind and for them to bring to bear their extensive experience in governance and executive roles to improve Fujitec’s financial sustainability, longevity, and stakeholder franchise for the future.

We find ISS’s analysis to be disappointing in its apparent failure to capture these elements of Fujitec’s current situation.

Share Price Performance

(Note: Please see the share price performance chart)

We do not dispute the factual observation in ISS’s report that Fujitec’s share price has risen by 11.9% and volume of trading in Fujitec stock has increased since the new Board members were elected (to 2 June 2023). However, we profoundly disagree with the implicit assumption that this increase is reasonably attributable to the February Board changes.

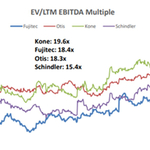

Over the same period, the Nikkei 225 Index has risen by 14.83%, and the comparable Japanese peers* in the sector by 17.71%. Moreover, as highlighted in our detailed presentation pack to investors, copied below, Fujitec’s improved Valuation Multiple has been broadly equivalent to those of competing companies in the global E&E sector internationally over recent months.

* Eikon Sector Analysis peer group include Daifuku Co., Ltd. (6383T), Mitsuboshi Belting Ltd (5192T), Moriya Transportation Engineering and Manufacturing Co Ltd (6226T) and NC Holdings Co., Ltd. (6236T)

Again, we find the lack of context and market/peer comparisons in ISS’s report to be highly disappointing. The incumbent board has in fact announced no new strategy or operational roadmap that might reasonably be seen to drive an improvement in share price performance. Nor has the board made any change to capital allocation strategy, while it has announced the same dividend payment for FY23 as was made in FY22 – an actual reduction in payout ratio compared to last year.

We encourage shareholders to consider their voting decisions in this context, not in response to a very superficial attribution error from ISS.

Perpetuating Board dysfunction

We appreciate that some shareholders might be inclined to conclude that the current Board has only been in place for a short time and should therefore be given an opportunity to prove itself before facing another shareholder vote. On the surface, such a position, as reflected in ISS’s recommendation, seems reasonable given the short period of time that has elapsed since the EGM in February 2023, and the amount of time typically required for a new Board to make tangible progress.

However, in this case we believe this conclusion would be dangerously uninformed and misconceived, and that ISS under-estimated the gravity of the situation at hand.

The facts are that the 4 Oasis candidates elected at the February EGM were only elected by a very thin margin (as little as 51%) which included Oasis’s 17% holding to achieve only a slight majority of overall votes cast.

- Only 3 months ago, at the EGM, the 4 Oasis Directors received on average a mere 54.6% vote support.

- The lowest 2 approved board members were Ako Shimada at 51.1%, and Clark Graninger at 51.8%.

- The highest approved board members were Kaoru Umino at 58.7%, and Torsten Gessner at 56.8%.

-

Kazuhiro Mishina, outside director, also does NOT have a clear mandate:

- His vote approval at the EGM was a mere 53.2%, with both ISS and Glass Lewis recommending against.

- He has no business experience and understanding of the industry (as he has a purely academic background) but is somehow the Chair of the Compensation and Nomination Committee, and has led the internal search for new CEO.

As can be seen above, none of the Oasis-aligned directors achieved a majority of votes at the EGM from genuinely non-affiliated shareholders, including large domestic and international institutional investors. In addition, the Oasis directors effectively purged or converted non-Oasis nominated outside directors.

The effect of this is that the EGM result was inconclusive and dysfunctional. The reality is that Fujitec now has a fractured Board with a dominating influence from a single, financially motivated investor, and no clear mandate from the plurality of the overall shareholder base.

In these circumstances, ISS subscribers should not adopt the position of simply supporting the status quo through inertia or a general “wait and see†mindset, by voting for current incumbents, whom many of them may not have supported in the February EGM when those same individuals were on the “dissident†side. The reasons for the strong voting opposition to the Oasis directors were entirely valid at the time and remain so today.

Instead, we urge investors to consider the overall package of skills, experience and governance oversight detailed in our individual candidate assessments below:

VOTE FOR the below candidates

|

Nominee |

Experience |

Notes |

|

Mr. Kazuyoshi Kimura |

Former Executive Chairman of Nikko Securities Co., Ltd. (currently SMBC Nikko Securities Inc.), CEO of Bic Camera. |

Thorough understanding of investor protection, including fair disclosure rules, developed through his practical experience in the financial securities industry. |

|

Mr. Hiroki Okimoto |

Former Partner of Boston Consulting Group |

Extensive practical experience in business management and rehabilitation in a wide range of industries spanning operating companies, financial institutions, and consulting firms, both within Japan and abroad and has been deeply involved in the growth and revitalization of businesses from the perspective of management, creditor / shareholder, and advisor. |

|

Mr. Kenji Uenishi |

Former GE Energy Asia-Pacific Region Headquarters President |

Holds extensive experience with international and large-scale operating companies and his knowledge gained through successful experience with global supply chains. |

|

Mr. Tetsuya Nishikawa |

Former Chief Cabinet Secretary, Defense Agency/Lawyer |

Outstanding practical experience in dealing with domestic and international fraud, criminal acts, and corporate scandals, as well as his ability to manage large organizations and carry out reforms. Will enhance the Company’s corporate governance in the areas of crisis management, scandal response, governance, and legal affairs. |

|

Mr. Daisuke Kotegawa |

Former Representative Director of Japan to the IMF |

Contribute to Fujitec’s long-term sustainable growth by using his world-class international experience and outstanding practical skills across the areas of finance, business revitalization, and corporate management. |

|

Ms. Maiko Hagiya |

Outside Director for the Cool Japan Fund Inc. / Lawyer |

Extensive knowledge and experience gained from her dedication to ensuring compliance and addressing challenges for women equality and human rights. |

|

Mr. Nobuki Sugihara |

Honorary Advisor of The Chiune Sugihara Memorial Foundation |

Contribute to Fujitec’s long-term growth by providing advice needed to develop the business globally and by helping formulate appropriate policies from an ESG (Environmental, Social and Governance) perspective. |

|

Mr. Akira Tsuda |

Former Nomura Securities Co., Ltd., Representative Director & Senior Managing Director |

Outstanding record and experience in growing and developing numerous companies and promoting compliance. |

More information can be found here – https://freefujitec.com/en/top/

Some Further Concerns

Our primary argument against the ISS recommendation lies in the combined strengths, independence, governance experience and complementary skills of the Nominees put forward in Resolutions 5.1-5.8 compared to the incumbent and new Oasis-aligned candidates.

Our objection to the ISS recommendation is that we believe their assessment does not properly capture the lack of a genuine mandate from shareholders reflected in the February EGM vote. Allowing the Oasis-aligned candidates to remain a dominant influence would simply be compounding an already compromised governance situation.

However, in our consultations with Fujitec’s broader stakeholder group, we have also been alerted to many other grounds for objection to the incumbent board’s behaviour.

We take this opportunity to pass on these concerns to shareholders to consider in your deliberations.

-

Multiple stakeholders have come forth to protest the Company’s current direction (e.g., replacing ALL internal directors, using emergency motions to pass board resolutions)

- Employee union of Fujitec has voiced their concerns with the current situation

- Letters from customers and business partners

-

Independence issues among the board members and no transparency in the director selection process

- Anthony Black, one of Oasis’s newly appointment board members, is from OTIS elevator (36 years at Otis), a direct competitor of Fujitec, where Torsten Gessner (20 years at Otis), who is another one of Oasis’s nominees, also spent time at Otis which held approximately 17% shares in Fujitec in 2008.

-

Current board and governance oversight

- The Company released a press statement noting that they had vetted all our shareholder candidates – but in fact, they only interviewed 4 of the 8. Extra interviews were offered only after their press statement.

-

Oasis’ past “investment companies†and their board of directors have resulted in declining performance

- Sun Corporation – In 2020, Oasis nominated and elected 5 directors, but after 3 years, the company is still posting negative operating loss and operating margin.

- Raysum Co., Ltd. – Oasis took majority ownership and installed their own employees to the Board. However, 6 months after Oasis took over, the share price fell over 20% and has still not recovered.

- Tenma Corporation – Oasis nominated and elected 3 board members at the AGM in 2021. However, 2 years later, the Company has underperformed the TOPIX index.

- Katakura Corporation – Oasis held shares in the company in 2017 and exited in 2021. During this time, sales decreased from 46.8 billon (FY 2017) to 37.6 billion (FY 2021), a 19.6% decrease. Although operating income increased during this period, this was “made possible†by an enormous SG&A decrease resulting from layoffs and voluntary retirement.

We believe that the proposed resolutions to appoint 8 shareholder director nominees are in the best interest of all shareholders.

I urge shareholders to support Resolutions 5.1 through 5.8 the Annual General Meeting to be held on 21 June 2023.

As a 10% shareholder, we are strongly motivated to contribute to the long-term financial performance of Fujitec as best we can. Please join our cause in, “One Board, One Company, One Fujitecâ€.

We welcome any discussion with our shareholders and are happy to further explain the strategic rationale for our proposals. If you would like to discuss the AGM proposals with us, please contact, [email protected] .

About Uchiyama International Co., Ltd:

Uchiyama International Co., Ltd, including affiliated companies, is a shareholder holding approximately 10% of Fujitec’s voting rights. Through its long-term ownership of Fujitec, Uchiyama International Co., Ltd. supports the enhancement of Fujitec’s corporate value and its contribution to society.

We are working toward, “One Board, One Company, One Fujitec”.

Contacts

KRIK (PR Agent)

Koshida: +81-070-8793-3990

Sugiyama: +81-070-8793-3989